It’s Time to Expand the EV Tax Credit

Source: Blue Green Alliance

The transportation sector is now the largest source of global warming emissions in the U.S., and most of that comes from passenger cars and trucks. So if we really want to get serious about taking action to combat climate change, we need clean cars as soon as possible. Congress can enact policies this year that will accelerate the transition to zero-emission electric vehicles (EVs).

One effective way Congress can encourage a technological shift on this scale is through the tax code, by expanding the tax credit for plug-in and hydrogen fuel cell electric vehicles (EV tax credit). This tax credit has helped drive EV innovation and adoption, leading to over 1 million EVs on U.S. roads today. Unfortunately, the EV tax credit is now phasing down for some manufacturers who have sold over 200,000 units. To avoid penalizing these market leaders, the manufacturing cap should be lifted.

A bipartisan Senate tax extenders proposal already shows there is some appetite for extending some clean energy tax credits this year, but it currently leaves out the EV tax credit. The House has yet to release a tax extenders proposal. If it does—and it should—it must include an expansion of the EV tax credit.

Members of Congress who want to demonstrate their commitment to climate action should ask their leadership and leaders on the House Ways and Means Committee and Senate Finance Committee to pass a tax extenders package this year, one that includes an expansion of the EV tax credit.

The EV tax credit is a climate policy solution that helps reduce transportation sector emissions in two ways: First, it immediately cuts emissions by displacing gasoline vehicles with EVs that emit less than half as much greenhouse gases on average. Second, it drives increased EV production, which leads to cost reductions and accelerated mass market acceptance. As electricity is increasingly supplied by clean, renewable resources, EVs on the road will become cleaner too.

In addition to the climate benefits, the EV tax credit delivers many others, including:

- Public Health – EVs reduce dangerous tailpipe pollution that affects cities across the nation. The American Lung Association recently published its “State of the Air” report for 2019, which found that 4 out of 10 Americans live in areas with unhealthy air, much of which comes from smog-forming ozone which develops from hotter weather and nitrogen oxides (NOx) and volatile organic compounds (VOCs) emitted from tailpipes. Many of the most ozone-polluted cities are also the ones with the most traffic congestion.

- Environmental Justice – Low-income communities and communities of color are exposed to more harmful tailpipe pollution because they tend to be near high traffic and freight zones and highways. The U.S. Centers for Disease Control and Prevention (CDC) recognize that “economically disadvantaged and minority populations share a disproportionate burden of air pollution exposure and risk.” In addition to cleaner air, EVs will deliver significant fuel and maintenance cost savings to those who face disproportionate financial burdens from everyday transportation costs.

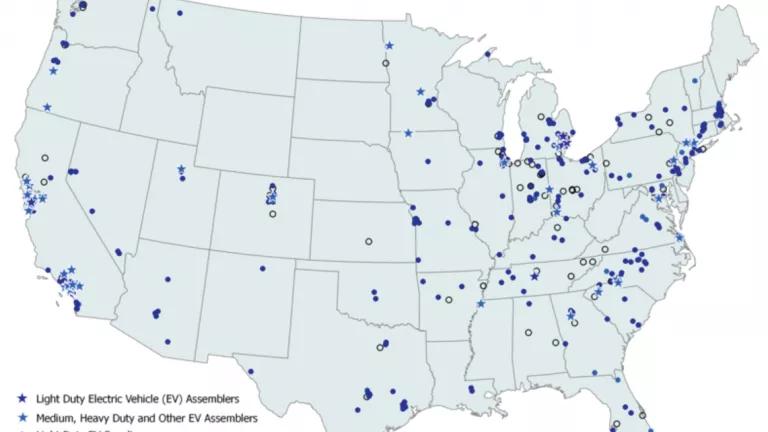

- Jobs – EVs already support thousands of high skill, high wage, advanced manufacturing jobs across the country. According to the 2019 U.S. Energy and Employment Report, EV manufacturing jobs grew by 20 percent to almost 68,000 in 2018. Expanding the EV tax credit can help accelerate this progress.

- Innovation and Global Competitiveness – As it did with gas-powered cars a century ago, the United States is leading the world in EV manufacturing and innovation. However, many countries around the world are quickly catching up, implementing aggressive policies to encourage EV adoption. China adopted California’s clean cars policies, including a zero-emission vehicle (ZEV) standard, and implemented it across its national market—the largest in the world. European countries are doing similar things to promote EV adoption, like providing generous tax credits and even setting dates to ban gas-powered vehicles. To maintain its lead in this increasingly competitive global market, the United States should at the very least expand the federal EV tax credit.

- National Security – The U.S. Department of Defense identifies climate change as a national security threat. America’s reliance on oil supports foreign actors and states who do not support U.S. strategic interests and puts American military personnel in harm’s way. The United States is also subject to oil prices set on the global oil market, increasing the vulnerability of our economic security. We can mitigate all these risks by switching to EVs.

Earlier this year the House passed H.R.9, the Climate Action Now Act, to demonstrate its support for the United States to stay in the Paris Climate Agreement. All House Democrats and three Republicans voted for it. We applaud this demonstration of commitment to climate action. Bringing that commitment into action can begin by expanding the EV tax credit.

Climate action can happen at the federal level right now. That is why we urge members of Congress to pass a tax extenders package this year—one that includes an expansion of the EV tax credit.