The Oil and Gas Bailout Is a Gusher

While U.S. employment numbers continue their freefall and signs of a global recession mount, oil prices have seen a steady rebound since a barrel of oil fell into a brief period of negative pricing in early April. With that rebound, one might expect the balance sheets of oil and gas producers to be looking a bit less troubled, and that these companies, so vocal in their calls for government support, to have stepped aside for those who actually need government aid. After all, people employed in nearly every sector are seeing layoffs, furloughs, and pay cuts, and it’s these workers--not corporations or their wealthy CEOs--that continue to be in need of government aid during these difficult times.

If only the oil and gas industry were that altruistic.

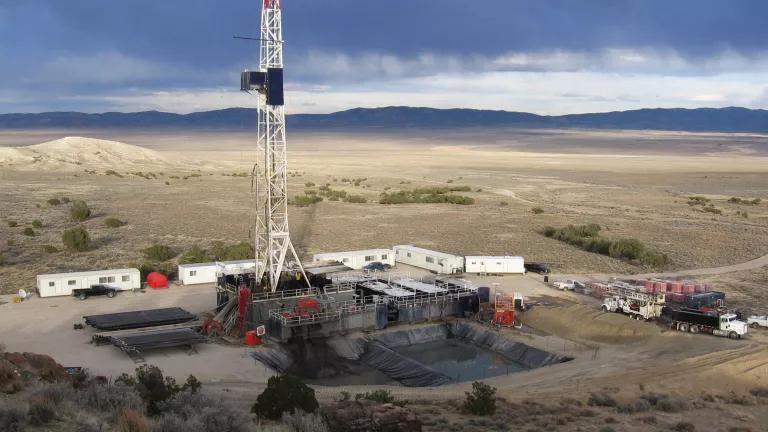

Instead, data pulled through May 18 tells a completely different story. As oil prices clawed their way back toward a “new normal”—they’re above $30/barrel today—a number of U.S. producers decided to take advantage of the economic uncertainty caused by global economic shutdowns to petition the Department of the Interior (DOI) for royalty relief. In other words, they asked that the U.S. government drastically reduce the amount of money they have to pay U.S. taxpayers for the oil they produce from the land and resources that we all own.

The data from the first half of May shows a rush by U.S. producers to take advantage of DOI’s invitation to apply for this relief. In total, at least 76 requests have been processed, with 100% of them honored. In most cases, royalties were cut from the standard 12.5% to as low as 2.5%. In hypothetical practice this means that, if a barrel of oil were sold for ten dollars, $1.25 of that sale was coming back to the U.S. Treasury. Now, some producers will only have to pay 25 cents per barrel, a sum that basically means DOI is granting oil and gas producers the right to use publicly owned resources for free. Add to that the fact that oil and gas production is one of the most damaging uses of our public lands, leaving behind a legacy of pollution and habitat degradation that is not easily rehabilitated

But wait, there’s more.

In quarterly financial filings from some of the companies who have been granted relief, there is now confirmation of additional massive taxpayer-funded bailouts via tax code changes contained in the Coronavirus Aid, Relief, and Economic Security Act (CARES Act). Consider QEP Resources’ first quarter financial results press release. Under CARES Act tax code changes, the company will receive $165.4 million in advance income tax credits. This follows on the heels of reports that these tax code changes create a pot of more than $13 billion that is particularly tailored to benefit companies with financial profiles similar to many current U.S. oil and gas producers.

Meanwhile, the only other publicly traded company receiving royalty relief in this first batch of requests—EOG Resources—just announced that it would proceed with payment of its annual dividend to stockholders. And despite the extraordinary downturn in oil markets, it managed to record net income well in the black.

And there’s even more.

In the midst of doling out cash to polluters, the Trump administration is reportedly going after solar and wind energy operators for retroactive rent payments. Despite efforts to provide economic cover to industries ranging from airlines to hospitality to fossil fuels, it now appears the one industry the administration has gone out of its way to hinder will take yet another economic hit. This is particularly worrisome given that recent reports also show that this industry has experienced job losses and other economic setbacks that are far beyond those faced by the fossil energy sector. It’s also bad policy. Renewables have seen extraordinary growth domestically and globally, with that growth expected to continue for decades as our energy system accelerates its move away from fossil fuels. It’s a trend that isn’t going to reverse, no matter how many times this administration tries to prop up the fossil past.

Billions of dollars in annual government subsidies is already far beyond what the public should be paying to the very fossil fuel companies leading us to the brink of the climate crisis. Adding billions more under cover of a global health emergency is a sinister and irresponsible use of public funds that should be spent instead to support workers facing prolonged unemployment and other economic hardships. And if we’re looking at how to invest in the energy future--a future with job creation potential far beyond that of fossil fuels--that future is electric and powered by renewables. It is high time the U.S. government started making smarter investments with the taxpayer dime.