A regional electricity transmission operator—almost certainly an expanded California Independent System Operator (CAISO)—may be inevitable despite last year’s failure of the California legislature to pass legislation to allow a West-wide grid operator. It’s needed in order to operate a wholesale energy market that can use the lowest-cost resources available to meet regional electric demand.

That was the conclusion from a forum I participated in last week with former CPUC commissioner Mike Florio, E3 analyst Jack Moore, and moderated by PG&E Principal Matt Lecar.

Why will this trend continue? The panel looked at many factors but four stand out.

Trends that lead to a much more coordinated regional grid are already underway. They include: the runaway success of the CAISO-supported Western Energy Imbalance Market (EIM); the regional policy alignment on climate mitigation because of the sweeping changes wrought in the 2018 mid-term national elections; coal’s death-spiral hastened by crashing prices for renewable energy; and, CAISO’s role in providing reliability coordination across most of the western interconnect. Taken together, these four factors lead in an obvious direction—a more coordinated western electrical system with, eventually, a full wholesale electricity market and region-wide power dispatch and transmission planning, though it may take some time for California politics to stabilize enough to support that.

The EIM: $650 million in benefits and counting

As Mike Florio noted, two ingredients are necessary for any regional market expansion to occur: trust and success. Trust that all market participants will be treated fairly and a record of success. The Western EIM ticks both those boxes and more. Unfortunately, it only looks at energy needs a few minutes ahead where a regional transmission operator could plan a day ahead or longer. The EIM is a “real time” market involving eight western states that trades the difference between the day-ahead forecast of power and the actual amount of energy needed to meet demand in each hour. If we need more energy than predicted, the real-time market—the EIM—makes up the difference.

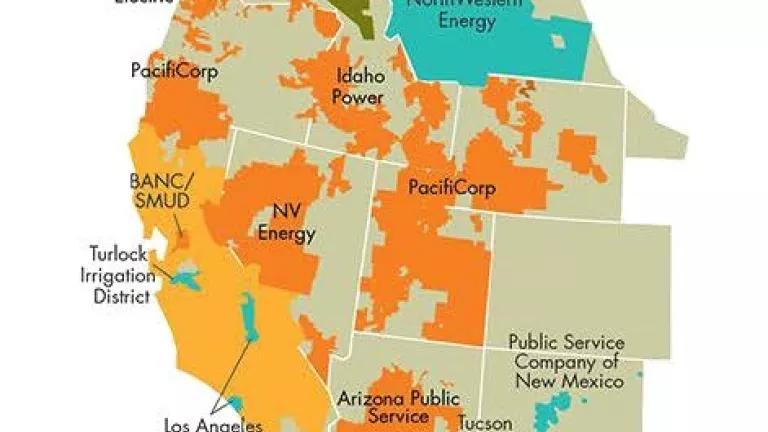

Since its inception in 2014, according to the most recent benefits reports, the EIM has garnered more than $650 million for participating entities, and more utilities – both investor-owned (IOU) and publicly owned (POU)—continue to flock to the market (see map below). Regardless of the utility business model, the EIM works. Benefits increase as more participants join the market and more transmission is made available. Major regional players in the POU category have either joined the market or announced their intent to do so, including heavyweights like the Los Angeles Department of Water and Power (LADWP), Arizona-based Salt River Project, Seattle City Light, and the Bonneville Power Administration (BPA), whose hydro system could function as a kind of battery for much of the West.

All this participation is occurring even though the EIM currently only includes around 5 percent of the overall energy demand in the West, the last-minute (“real time” five- and 15-minute increments) energy needed to keep the system in balance. The CAISO and the EIM governing body (the EIM is not directly run by just the ISO Board of Governors) are considering new products that should make it easier for northwest hydropower generators to participate, via a new day-ahead market for hourly transactions. These market extensions are expected to further build trust while providing even greater benefits for market participants, adding energy, balancing services and transmission resources to the already robust EIM.

The West is more aligned on climate goals

The 2018 elections ushered in a new era of climate action from western states as new governors and legislatures enacted sweeping policies that should spur both new renewable energy development and the need for more effective regional coordination of grid operations. California can no longer be viewed as an isolated western entity subject to hostile policies from other nearby states, a key fear of opponents of grid regionalization. Instead, California is now closely aligned with states representing most of the region’s electrical demand.

For example:

- Washington and Nevada adopted new standards and Colorado moved closer to approving a 100 percent net-zero-carbon target for 2050.

- California last September set a net-zero-carbon target by 2045.

- In March, New Mexico Gov. Michelle Lujan Grisham signed a bill boosting renewable energy targets and setting a goal of zero-carbon electricity by 2045.

- Colorado Gov. Jared Polis, a Democrat elected in November, campaigned on getting the state to 100 percent renewable energy by 2040.

- Nevada Democratic Gov. Steve Sisolak signed a bill committing Nevada to raising the state renewable portfolio standard (RPS) to 50 percent by 2030 and setting a goal of zero-carbon emission by 2050.

This alignment means the need to coordinate across the region to cost-effectively meet these goals will increase as these states’ utilities scramble to buy or build new renewable generation and transmission capacity to meet their goals. Better coordination means they can share operating reserves instead of building duplicative generation, allowing them to cost-effectively meet system stresses; use regionally produced renewables to meet demand in almost all hours, obviating the need for gas plants to serve peak loads; better use the capacity of existing transmission lines by reducing congestion caused by reserved and unused transmission rights; and, more rapid phasing out uneconomical coal and gas plants. The “Trust Factor” just got a whole lot better for California.

Crashing Renewable Energy Pricing Accelerates the Coal Death Spiral

Another factor pointing to the likelihood that a regional market could emerge is the continued, headlong decline of the coal sector. Fear that the life span of coal plants would somehow be extended in a regional market—one argument used against California legislation to expand the ISO—has been largely proven untrue. The success of the EIM, which has resulted in better use of surplus regional renewable energy and less use of fossil generation, has proven it wrong. In fact, one of the main benefits of the Western EIM has been reduced curtailment (shutting down renewable generation—primarily solar plants—when it can’t meet local demand) which has slashed carbon dioxide (CO2) emissions elsewhere in the region. The EIM’s cumulative numbers through the first quarter of 2019 are: 810,116 megawatt hours of reduced curtailment and 346,649 fewer tons of CO2 emitted. And these numbers are just for the EIM’s real time market, just 5 percent overall energy demand in the West. As the EIM continues to grow, the benefits will also. In a full regional wholesale market, coal has no foreseeable future, and natural gas plants will be increasingly out of the money.

Fossil generation’s decline is being caused in large part by an accelerating crash of the capital and marginal costs of renewable power. 2018 saw the lowest renewable electricity prices ever, with some bids for solar with storage dropping below natural gas prices.

The West is more aligned on climate goals

The 2018 elections ushered in a new era of climate action from western states as new governors and legislatures enacted sweeping policies that should spur both new renewable energy development and the need for more effective regional coordination of grid operations. California can no longer be viewed as an isolated western entity subject to hostile policies from other nearby states, a key fear of opponents of grid regionalization. Instead, California is now closely aligned with states representing most of the region’s electrical demand.

For example:

- Washington and Nevada adopted new standards and Colorado moved closer to approving a 100 percent net-zero-carbon target for 2050.

- California last September set a net-zero-carbon target by 2045.

- In March, New Mexico Gov. Michelle Lujan Grisham signed a bill boosting renewable energy targets and setting a goal of zero-carbon electricity by 2045.

- Colorado Gov. Jared Polis, a Democrat elected in November, campaigned on getting the state to 100 percent renewable energy by 2040.

- Nevada Democratic Gov. Steve Sisolak signed a bill committing Nevada to raising the state renewable portfolio standard (RPS) to 50 percent by 2030 and setting a goal of zero-carbon emission by 2050.

This alignment means the need to coordinate across the region to cost-effectively meet these goals will increase as these states’ utilities scramble to buy or build new renewable generation and transmission capacity to meet their goals. Better coordination means they can share operating reserves instead of building duplicative generation, allowing them to cost-effectively meet system stresses; use regionally produced renewables to meet demand in almost all hours, obviating the need for gas plants to serve peak loads; better use the capacity of existing transmission lines by reducing congestion caused by reserved and unused transmission rights; and, more rapid phasing out uneconomical coal and gas plants. The “Trust Factor” just got a whole lot better for California.

Crashing Renewable Energy Pricing Accelerates the Coal Death Spiral

Another factor pointing to the likelihood that a regional market could emerge is the continued, headlong decline of the coal sector. Fear that the life span of coal plants would somehow be extended in a regional market—one argument used against California legislation to expand the ISO—has been largely proven untrue. The success of the EIM, which has resulted in better use of surplus regional renewable energy and less use of fossil generation, has proven it wrong. In fact, one of the main benefits of the Western EIM has been reduced curtailment (shutting down renewable generation—primarily solar plants—when it can’t meet local demand) which has slashed carbon dioxide (CO2) emissions elsewhere in the region. The EIM’s cumulative numbers through the first quarter of 2019 are: 810,116 megawatt hours of reduced curtailment and 346,649 fewer tons of CO2 emitted. And these numbers are just for the EIM’s real time market, just 5 percent overall energy demand in the West. As the EIM continues to grow, the benefits will also. In a full regional wholesale market, coal has no foreseeable future, and natural gas plants will be increasingly out of the money.

Fossil generation’s decline is being caused in large part by an accelerating crash of the capital and marginal costs of renewable power. 2018 saw the lowest renewable electricity prices ever, with some bids for solar with storage dropping below natural gas prices.

According to the "Renewable Power Generation Costs 2018" report, published by the International Renewable Energy Agency (IRENA), renewable power has become the cheapest source of electricity in many parts of the world. The report predicts that cost reductions for solar and wind technologies are set to continue until 2020 and beyond. The report goes on to forecast that 77 percent of onshore wind and 83 percent of utility-scale projects due for approval in 2020 will have lower electricity prices than the cheapest fossil fuel-fired generation. This is an economic juggernaut giving renewable energy sources an unbeatable advantage in a regional wholesale energy market, which selects the lowest available marginal cost resources to meet demand in the next day.

Some fear that renewable prices could drop too low, suppressing investment in new clean energy projects, especially as costlier sources of generation that usually prop up market prices depart the grid. The solution could be the addition of a long-term energy market to stabilize prices. Markets have shown themselves to be coal’s kryptonite and are allowing clean energy to challenge the business case for new gas plants.

Regional Reliability Coordination (RC) Builds Trust and Could Encourage Regional Markets

Another factor pointing to the possible development of a regional Independent System Operator and a coordinated wholesale energy market is the consolidation of most western reliability coordination (RC) services to the CAISO. Nothing builds trust like close coordination and success in keeping the lights on. The RC function allows for a centralized ability to see what is happening in the entire western grid at any given moment, and to alert balancing authorities to respond instantaneously to system failures like the unexpected loss of transmission or a generator. This function is not too far off from how a regional RTO would operate its grid. In fact, most U.S. RTOs provide the RC function throughout their own footprint.

According to the "Renewable Power Generation Costs 2018" report, published by the International Renewable Energy Agency (IRENA), renewable power has become the cheapest source of electricity in many parts of the world. The report predicts that cost reductions for solar and wind technologies are set to continue until 2020 and beyond. The report goes on to forecast that 77 percent of onshore wind and 83 percent of utility-scale projects due for approval in 2020 will have lower electricity prices than the cheapest fossil fuel-fired generation. This is an economic juggernaut giving renewable energy sources an unbeatable advantage in a regional wholesale energy market, which selects the lowest available marginal cost resources to meet demand in the next day.

Some fear that renewable prices could drop too low, suppressing investment in new clean energy projects, especially as costlier sources of generation that usually prop up market prices depart the grid. The solution could be the addition of a long-term energy market to stabilize prices. Markets have shown themselves to be coal’s kryptonite and are allowing clean energy to challenge the business case for new gas plants.

Regional Reliability Coordination (RC) Builds Trust and Could Encourage Regional Markets

Another factor pointing to the possible development of a regional Independent System Operator and a coordinated wholesale energy market is the consolidation of most western reliability coordination (RC) services to the CAISO. Nothing builds trust like close coordination and success in keeping the lights on. The RC function allows for a centralized ability to see what is happening in the entire western grid at any given moment, and to alert balancing authorities to respond instantaneously to system failures like the unexpected loss of transmission or a generator. This function is not too far off from how a regional RTO would operate its grid. In fact, most U.S. RTOs provide the RC function throughout their own footprint.

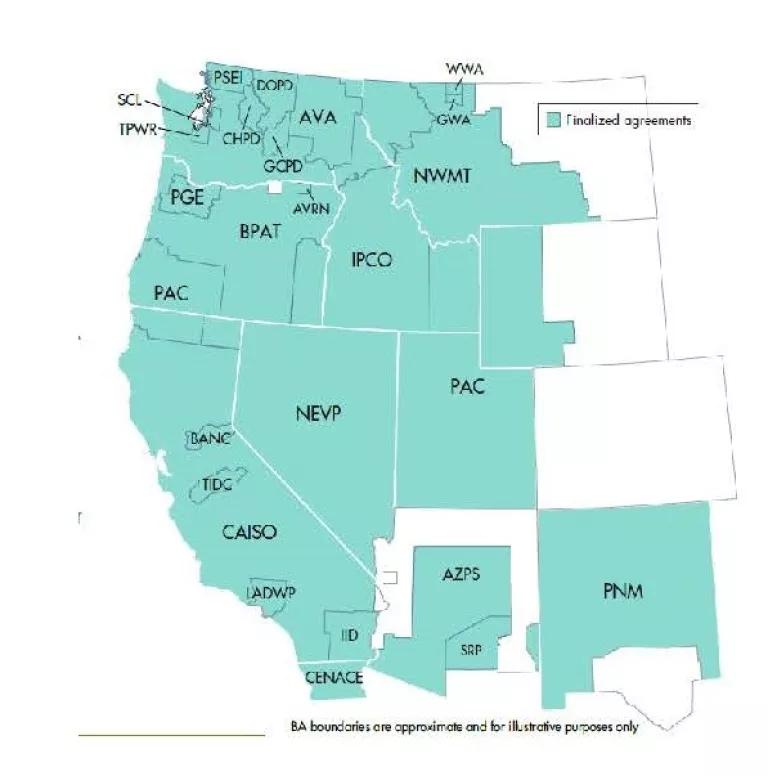

As the map, below shows, fully 80 percent of western balancing authorities have contracted for reliability services with CAISO.

When taking all these factors into consideration it should come as no surprise that the case for a regional ISO and its wholesale electricity market is expected to only get stronger. The fly in the ointment so far has been the unwillingness of the California Legislature to relinquish its unique privilege to appoint the CAISO Board of Governors. Will lawmakers continue to insist on the state’s isolation from a regionally dynamic market, insisting on a false sense of control (the CAISO is regulated at the federal, not state, level) or will the governor and the California Legislature move to capture the market’s benefits, and in doing so work with its neighbors to cost-effectively reduce the greenhouse gas emissions that threaten the future of the West’s people and resources?