As you may have heard, after a lapse Congress restored parity between drivers and transit riders when it comes to non-taxable commuting costs. Good articles have been written about this laudable turn of events here and here.

As of this year drivers get to shelter $240 per month from taxes, or nearly $3,000 annually. Thanks to the 2009 Recovery Act, the benefit for those of us who take transit jumped to the same level as drivers until last fiscal year (or FY, and for the feds these begin 10/1 of the preceding year), when it dropped to just $125 monthly. Congress made benefit parity retroactive so transit commuters get equal footing with drivers for both 2012 and 2013 FYs. As I type this, the IRS and HR departments are working to figure out how exactly retroactive implementation works!

This transit benefit seems to attract attention fairly frequently. It's puzzling that the parking benefit escapes similar questioning.

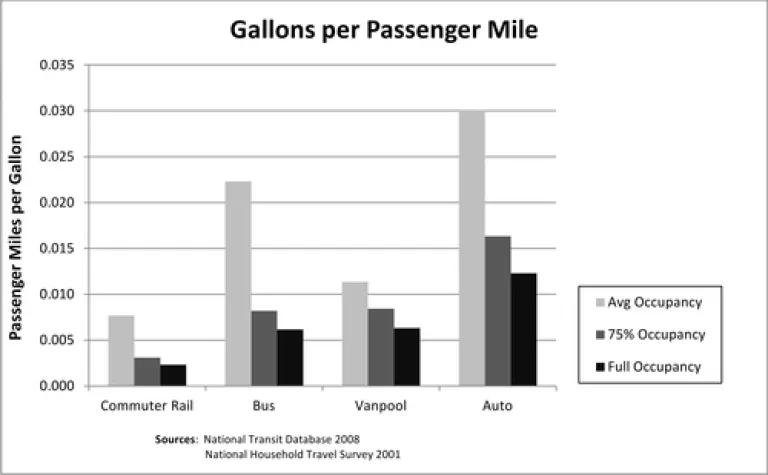

For starters, transit ridership delivers societal and environmental benefits and so is worth promoting. For example, taking the bus or train to work, especially if the vehicle is reasonably well-loaded, yields substantial fuel savings and pollution reduction as you can see from the graph below based on national average vehicle efficiencies.

The other reason to turn the spotlight on the parking benefit is that it is much, much larger. How much bigger? According to the IRS, in 2012 alone the parking benefit cost $3.18 billion, whereas transit cost $520 million. So subsidizing parking cost taxpayers more than six times as much. That's where the big potential fiscal savings are vis-a-vis commuter benefits.

So a smart policy move -- fiscally and environmentally -- would be to keep the transit benefit but eliminate the parking one.

However, if parity is the name of the game here, so there's a level playing field between modes of transportation, it may make more sense instead to provide some benefit to those who take carpools or vanpools to work too. And a smaller benefit could be provided to the hardy souls who bike to work daily (say $50). This would presumably have a modestly bigger fiscal effect, but the societal and environmental payoffs could trump that.

Or to even the playing field even more the feds could offer, as California does, "parking cashout." Employees are given a flat monthly benefit for commuting expenses, and they decide what to do with it. There's good analytical evidence that cashout amounts to an economic incentive for not driving alone to work, which stands to reason since if I bike or walk (or telecommute, as I'm doing today), I pocket some of that money for uses other than buying gasoline.

Such alternatives are worth considering, given the benefits. And if fiscal savings is top priority, we should really question whether we should continue pouring billions of our taxpayer dollars into exacerbating peak road commuting hours.