Utility investment in energy efficiency programs continues to increase, but we need more

Energy efficiency programs - rebates, information, and market development efforts that make saving energy in our homes and businesses easy and cheap - are a key piece of the nation's clean energy strategy. A new report shows that last year, electric utilities, natural gas utilities, and states invested more than ever - $7.6 billion - in these programs, cutting pollution, lowering energy bills, and reducing the need for expensive power plants. The Consortium for Energy Efficiency (CEE) report demonstrates that investment has increased in recent years: program managers $7.3 billion for energy efficiency programs in 2013 and, for comparison, $4.4 billion for energy efficiency programs in 2008.

Program managers' 2013 investments saved 24,000 gigawatt-hours of electricity in 2013 alone, enough energy to power 2.2 million U.S. homes for a year. Because saving energy is on average much cheaper than building a new power plant, this investment is a great deal for customers.

The CEE report also helps answer some (relatively) common questions about energy efficiency programs.

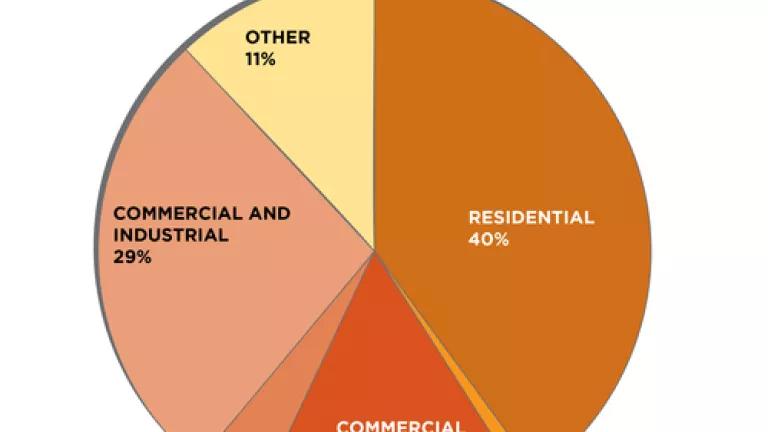

How is the investment split between residential and business customers?

Investment is somewhat tilted toward residential customers. Electric and natural gas utilities in 2013 split their spending on energy efficiency programs 50/50 between residential and business customers, while residential customers are responsible for around 37 percent of electricity use and 31 percent of the natural gas not used in vehicles or power plants.

What about energy savings?

The graphs below (from the report) show that electric programs for residential customers accounted for about 40 percent of savings, while the residential customer share of savings from natural gas programs was 35 percent.

What are the biggest programs?

Programs that provide standard rebates for common retrofits in businesses (like changing out a lighting system), programs that provide businesses a set rebate for each unit of energy saved (called "custom" programs), programs targeted at low income customers (usually no-cost efficient lighting, appliances, and building shell improvements), and residential lighting programs receive the most investment from utilities.

How much of the investment goes to rebates and incentives versus marketing and everything else?

About 54 percent of electric program spending and about 57 percent of natural gas program spending goes to rebates and incentives.

But compiling the data should not be this hard

Like the excellent recent reports on the cost of energy efficiency programs from Lawrence Berkeley National Laboratory (LBNL), the CEE report is the product of a herculean research effort. Each state and utility has unique reporting requirements and formats, similar programs go by different names or are rolled up into larger programs, utilities' program years start and stop on different dates, and program savings are measured and reported using different methodologies. This makes constructing a national picture of energy efficiency investment difficult, and impedes research and benchmarking efforts that could improve program effectiveness. It should not be this hard.

The energy efficiency industry has made progress toward standardization. The US Department of Energy-managed Uniform Methods Project is developing standardized algorithms for calculating savings from common energy efficiency measures, like LED light bulbs or lighting controls in businesses. LBNL and CEE have worked together to develop a typology of energy efficiency programs and definitions of metrics for describing program performance and characteristics. Program managers, advocates, and researchers can better determine "what works" in energy efficiency programs when they make apple-apple comparisons. Advocates (like us at NRDC) should make convincing program managers to adopt standardized program reporting and description methods more of a priority, as mundane as that sounds.

"Increasing less quickly" is not bad

Beyond that, energy efficiency program investment, while not declining, is increasing less quickly than it was in the 2007-2011 period. When I adjust for inflation (goods and services were around 1.6 percent more expensive in 2014 than 2013) and population growth (the U.S. population grew by about .7 percent between 2013 and 2014), budgets only increased around 1.7 percent between 2013 and 2014. As we make progress toward reducing greenhouse gas emissions from power plants under the Environmental Protection Administration's Clean Power Plan, we are going to need to ramp up energy efficiency program spending and effectiveness.

That said, for an industry used to boom and bust investment cycles, "increasing less quickly" is not too shabby.