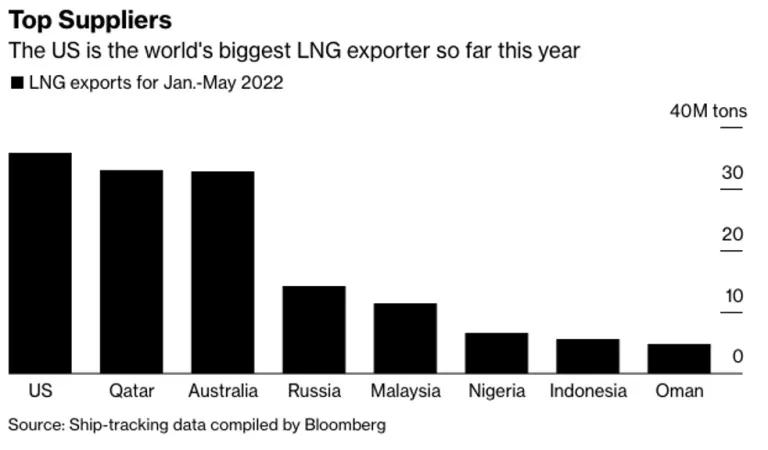

Growth of U.S. LNG Exports Puts Global Climate at Risk

The planned expansion of U.S. LNG exports allows the domestic fossil gas sector to continue growing its profits without shouldering any responsibility for the associated climate and environmental impacts domestically and in importing nations.

LNG ship / NOAA

As Liquefied Natural Gas (LNG) becomes a focal point of energy security and energy transition discussions amongst the fossil gas industry, it is important to state that the expansion of United States. LNG infrastructure is unsustainable and deeply harmful for communities and the planet. Whether one looks through the lens of the greenhouse gas (GHG) emissions and climate risk or geopolitics the grounds for expanding U.S. LNG infrastructure and exports are dubious.

The unconditional support for U.S. LNG industry’s expansion that saw a renewed push in early 2022 undermines the U.S. Administration’s position as a climate leader. For the U.S. to establish itself as a true climate leader it should focus on supporting allies and U.S. LNG importing nations in achieving a just energy transition which meets both their long-term energy security and decarbonization goals. The current rush to create new LNG export facilities in the United States is at best a stopgap measure toward addressing security of energy supply concerns.

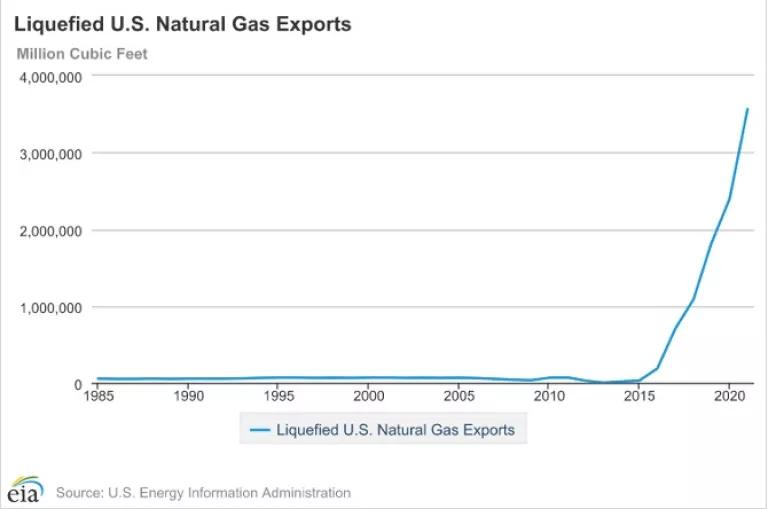

U.S. LNG exports growth rate incompatible with 1.5°C

The U.S. almost tripled its global LNG exports between 2019 and 2021. This growth is incompatible with the Paris Agreement climate goal of limiting global warming to 1.5°C. The International Energy Agency’s (IEA) Net Zero by 2050 report models the global energy supply mix and the need to shift away from fossil fuels to achieve a net-zero energy sector by 2050 and to stay within the 1.5 °C threshold. The IEA report suggests that global use of fossil gas must be 55 percent lower by 2050 compared with 2020 levels.

Growth Of U.S. LNG Exports (1985-2021)

The short-term push for supporting European gas demand is creating long-term sources of GHG emissions across the U.S. The U.S. fossil gas sector accounted for almost 36 percent of the total emissions from energy consumption annually in 2020. If U.S. LNG exports increase to 6 trillion cubic feet of gas by 2030, as per U.S. EIA estimates, NRDC’s analysis states that the additional emissions that would result could be enough to erase the annual 1 percent decline in U.S. emissions that was recorded in the decade ending in 2020. Record expansion of fossil gas production is happening to meet the new contractual obligations of the U.S. LNG exporters. This will create new and lasting GHG emissions sources which is absolutely inconsistent with climate commitments.

Energy security argument has limitations

The U.S. fossil gas industry claims that increasing LNG exports in the long term is vital to the national security interests of importing nations because it ensures their access to a diversified fossil gas supply. However, these claims are at best a half-truth, especially around the ongoing European gas crisis. Further dependence on imported LNG only prolongs our allies’ exposure to global market volatility and price shocks and embeds long-term import dependence.

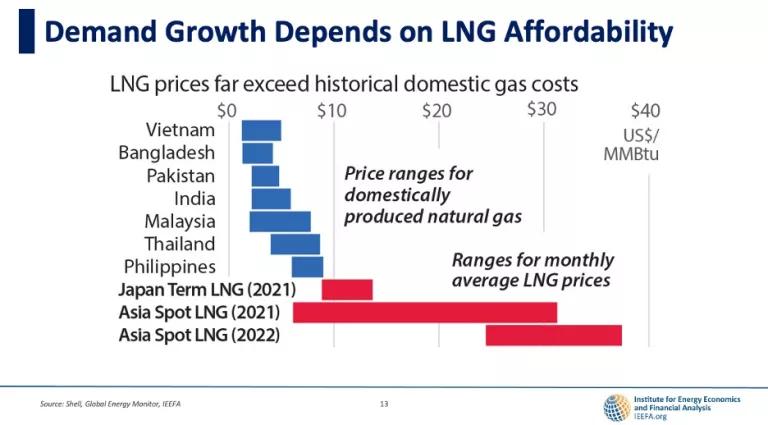

There is an emerging consensus among energy experts that the days of low gas prices may be over for the foreseeable future in Europe and worldwide. Fossil gas contracts for future deliveries, especially in Europe, are increasingly factoring in high prices for 2023, 2024, and likely even beyond. Any energy security benefits Europe may obtain from relying on U.S. LNG supply will be shaded by the risks associated with higher LNG prices and could deepen the current energy supply shock.

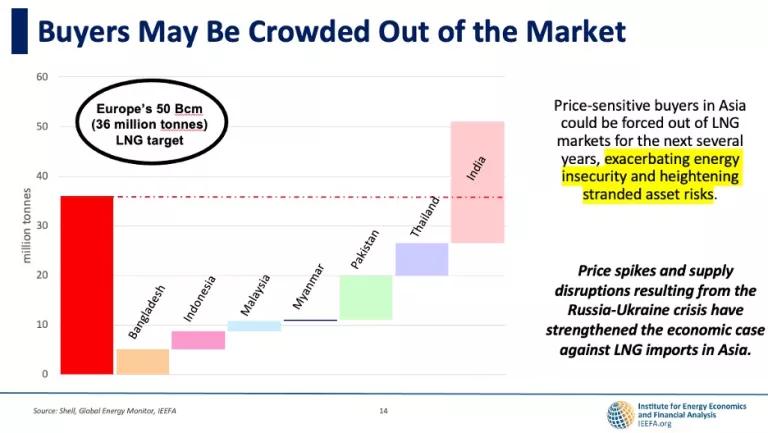

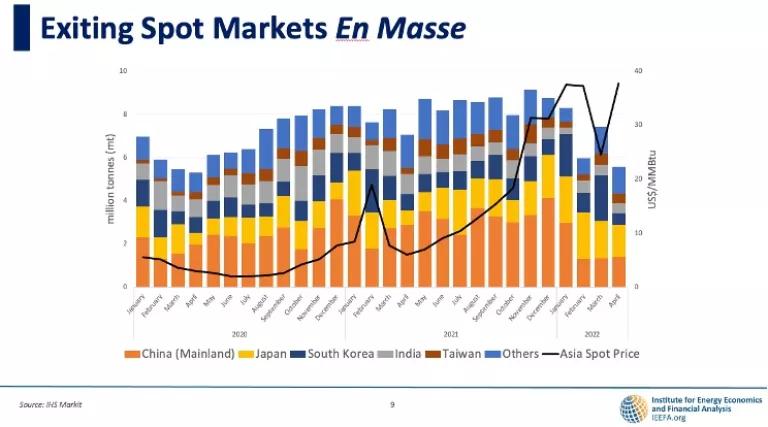

In Asia which has more price sensitive markets, the risk of blackouts and economic slowdown are emerging as countries are being priced out of the global fossil gas markets. Import dependency on a volatile commodity like LNG is unlikely to add to the energy security of countries with limited economic resources. Even other top fossil exporters like Australia are struggling with domestic gas shortages and surging energy prices due to the global market turmoil.

Rising risk of limited lifespans for new assets

U.S.-supported multilateral development banks (MDBs) continue to play a significant role in funding fossil gas expansion in Asia. Such public finance support is key to the success of expensive fossil energy projects. Since these projects have limited potential to be repurposed cost effectively, they will no longer be able to generate an economic return in the wake of sustained high fuel prices and changes associated with decarbonizing the global economy.

Any unlimited expansion of fossil gas infrastructure overseas could inadvertently create future stranded assets. In both the developed and developing parts of the world, building new fossil gas or LNG infrastructure is a risky investment. In Southeast Asia, 65 percent of existing and planned fossil gas plants would be incompatible with the 1.5 °C temperature target. In Poland, new renewable capacity is already cheaper than planned new large-scale fossil gas, meaning that any new large-scale fossil gas projects there could be forced to close well before their useful life is over.

Sustained high prices for LNG imports and geopolitics are now sparking concerns in non-European markets. In countries like Bangladesh and Pakistan their large historical investments in gas-based power generation could be at risk of becoming stranded assets earlier than otherwise planned.

Effects of U.S. LNG import dependence

Both developed and developing countries who planned to rely on LNG as a bridge fuel are being exposed to the potentially debilitating impacts of LNG import dependence. Asian LNG import demand has fallen close to 10 percent compared to last year's levels so far this year. Countries like Japan and Korea , two of the largest importers of U.S. LNG, are seeing spikes in LNG prices correspond to elevated power tariffs as domestic utility companies struggle to cope with the high cost of fuel for gas-fired power plants.

Developing nations across Asia looking to build out LNG import infrastructure as part of their transitions away from coal face similar challenges. Countries like Vietnam and the Philippines run the risk of locking themselves into reliance on expensive and carbon intensive fuels or pouring public financing into new LNG related infrastructure that may be retired before the end of its useful life. Either outcome could potentially stunt progress toward climate and developmental goals. Instead accelerating development of cost-effective non-fossil energy infrastructure lessens exposure of U.S. LNG importing nations to these risks, paving the way to a more sustainable energy transition.

In this moment of cascading energy, food, and climate crises it is vital that the U.S. Administration makes decisions to meet the challenges of the present head on without jeopardizing our common future. Our detailed report further explains why the continued expansion of U.S. LNG export infrastructure limits collective progress toward climate mitigation and long-term energy security goals. Political will must be exercised on both sides of the Atlantic to prioritize and deliver on the commitments made at the Glasgow and Paris climate summits.