PJM Auction: Wind, Solar, Efficiency Still Face Barriers

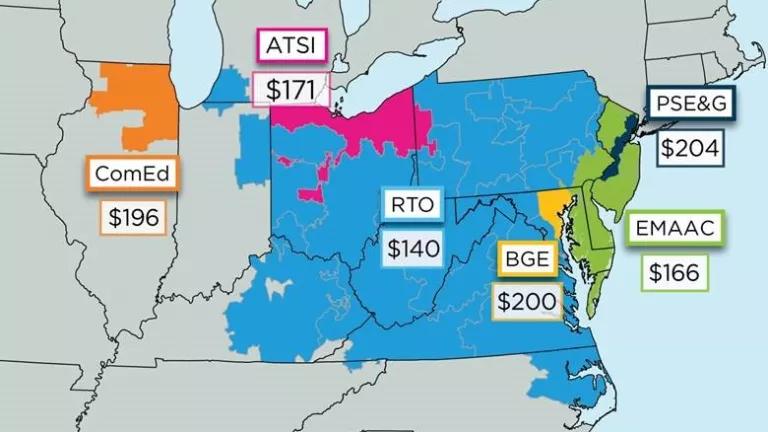

Source: PJM

PJM’s latest auction for utilities to buy and sell commitments to deliver electricity in the future, known as capacity, produced prices nearly twice as high as the previous year, and even at these higher prices, PJM still over-procured capacity. That means the 65 million electricity customers served by PJM will be paying too much at too high of a price per megawatt of capacity. And while the auction results show an uptick in market participation of renewable and demand-side resource participation, PJM’s market rules still impose unnecessary structural barriers to these fuel- and emissions-free resources. Experts have recommended changes to mitigate these market flaws, which we hope PJM will adopt.

Market rules still impose structural barriers to seasonal resources

PJM has new penalties for non-performance adopted after the 2014 Polar Vortex that stressed its grid, when a lot of gas and coal power plants went offline during the extreme cold. Under the new rules, generators that are committed to provide electricity would be penalized if they fail to perform during times of emergency conditions.

These penalties together with the more problematic requirement that capacity can only be bought or sold in year-long commitment periods drastically reduced participation from fuel- and emissions-free seasonal resources last year (such as wind and solar power, and clean demand-side resources like increasing air conditioning efficiency). The year-long commitment requirement favors annual resources that can burn fuel at all times of the year, such as nuclear, coal, and gas power plants.

Seasonal resource participation rebounded this year, but that does not mean that PJM is off the hook for eliminating structural market barriers impeding full participation of these resources. To put their capacity market participation in perspective, wind resources constituted less than 0.9 percent of the total amount of capacity PJM procured and solar resources were less than 0.4 percent of total capacity.

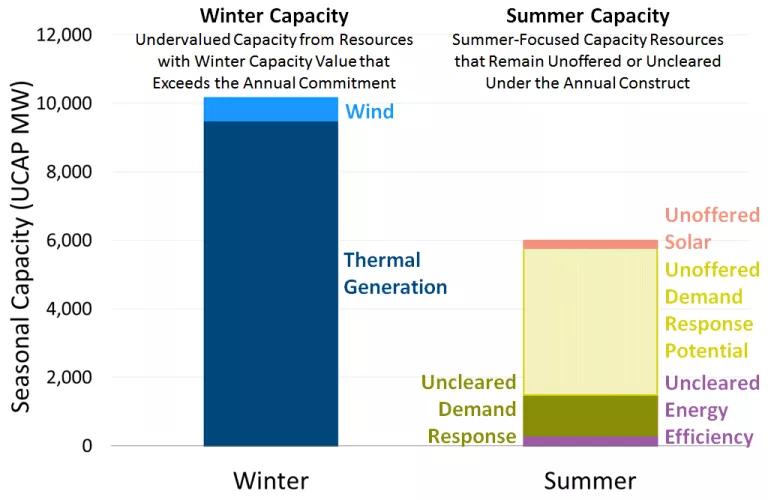

A lot more seasonal capacity is available on PJM’s system today than can participate in PJM’s capacity market. Many of these fuel- and emissions-free resources are growing and that trend is expected to continue as our generation fleet decarbonizes, but without the ability to participate in the capacity market, their capacity is undercounted (resulting in PJM over-procuring capacity), and these resources lose out on capacity market revenue.

Source: Brattle

Further, the uptick in participation from some of the resources that typically don’t have year-round availability may be due in part to a low likelihood of experiencing emergency conditions that trigger penalties, as PJM has a lot of excess generation. The risk of penalties will rebound as PJM sheds surplus, so additional resource participation this time due to risk perception may wane with power plant retirements and the annual-only requirement looms larger.

PJM’s matching mechanism still insufficient

PJM’s mechanism that matches summer and winter resources to form annual resources still has done relatively little to facilitate their participation. Less than 0.44 percent of the total capacity PJM procured could match to participate in the latest auction via PJM’s mechanism (a bit more than 700 megawatts). Summer-only resources were a mix of demand response (e.g., smarter use of air conditioning), energy efficiency (e.g., more efficient air conditioners installed), and higher levels of solar power in the summer. But more summer-only resources were offered than winter-only resources (largely winter wind power), which meant that even though summer resources were available to cost effectively satisfy summer demand, PJM procured annual resources instead, even if they were more expensive.

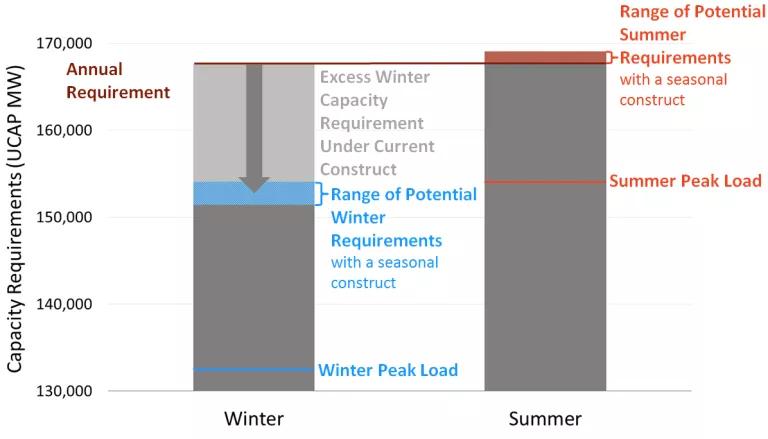

Aggregating seasonal resources to make them conform to an annual-only market is like forcing a square peg in a round hole. But to take the analogy further, the peg and the hole should naturally match given that PJM’s summer peak needs are much higher than its winter peak needs. In fact, insisting on only annual capacity over-procures in the winter.

Source: Brattle

Experts: market rule changes would improve efficiency

Analysis from the Brattle Group confirms that a two-season market would ensure at least the same level of reliability at lower cost and reduce barriers to seasonal resource participation.

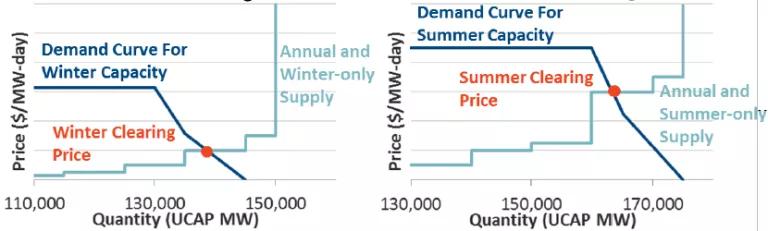

The two-season auction takes into account summer and winter demand and supply. It could be implemented via a straightforward extension of the existing capacity auction mechanism and would enable suppliers to more flexibly bid into the auction on a summer-only, winter-only, and/or annual basis. (An annual bid would win if it beats the average of the summer and winter clearing prices.)

The clearing price is the intersection of the supply and demand curve, and while it would initially be lower for winter resources because winter is currently more oversupplied, the two-season auction would signal older, less economic resources to retire in each season. Less efficient winter or annual resources would retire, and winter prices would rise to reflect a more balanced winter supply and demand.

Suppliers of annual resources would have more options as they can still bid in annually and bid in each season contingent on not clearing as an annual resource if they so choose. Resources that clear one season but not the other can undergo maintenance for the season or export capacity that is not economic in PJM. This mechanism also does not introduce uncertainty for annual resources as they could bid and receive one annual price, just as they do under the current construct. Thus, the two-season auction would improve the efficiency and flexibility of the capacity market without increasing uncertainty for suppliers.

Designing the market to be more flexible will help accommodate a wider range of resources and more efficiently value them. This is important because innovation will continue to drive development in cleaner and more efficient technologies that will displace more traditional and costlier power plants. A two-season market would more flexibly allow for mid-year resource additions and retirements. Further, more resource sharing between neighboring grids is key as wind and solar power grow and the grid enables customers to access power from windier and sunnier regions—a two-season market would more efficiently facilitate seasonal imports and exports.

The flexibility of two-season auction would also better accommodate future changes in demand as well as supply. Changes in how customers use electricity, such as the electrification of transportation and heating may change summer and winter peak demand.

PJM should heed expert advice to eliminate structural barriers that impede market participation from seasonal resources. As PJM’s independent market monitor has pointed out, PJM has the lowest percentage of wind and solar penetration of any FERC-regulated regional grid operator. Here is one market rule change PJM could take to remedy that.