For Our Children--and the Economy--Congress Must Act Now to Continue Tax Incentives for Renewable Energy

Written with Pierre Bull

Few of us have the tedious details of the U.S. tax code on our minds during this holiday season. But one of the best gifts Congress could give us—and future generations—would be to extend the renewable energy tax incentives expiring this month. Without congressional action, only the long-subsidized fossil fuel industry will benefit.

As our colleague Franz Matzner recently explained, “With precious little time left before the end of the year, our elected leaders will have to make a choice whether to continue the status quo or chart a new course that stops privileging these established, polluting industries over cleaner, healthier alternatives.”

Our colleague Meg Waltner will detail tomorrow why it is vital for Congress to extend tax credits for energy efficiency—which is always the cleanest, cheapest, quickest energy resource. But it’s also crucial to renew the Production Tax Credit (PTC) and the Investment Tax Credit (ITC), so the nation can continue its rapid expansion of clean wind power and launch the offshore industry by harnessing the power of our strong coastal winds.

Production Tax Credit: Key to the Continued Swift Scaling Up of Wind Power On Land

The PTC, which provides a tax credit to wind projects for the clean, renewable power they generate, has played a valuable role in advancing wind power and growing an industry that now provides jobs to more than 80,000 Americans. Last year alone, the PTC helped catalyze $25 billion of private investment into our economy. Extending the PTC and preserving and bolstering other successful federal and state policies will help U.S. communities in a variety of ways, from keeping and creating local jobs, to cleaning up local air and water, to increasing government revenues that can be reinvested in schools and roads, to growing local industries that can benefit the entire area.

Continued investment in wind and solar can double their current production and add another 200,000 jobs.

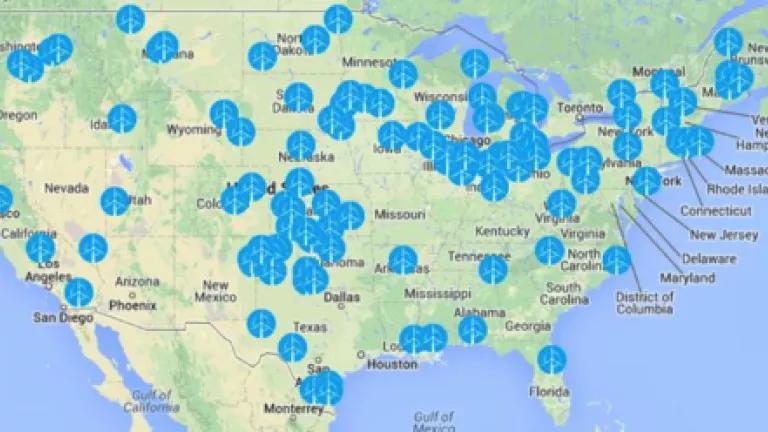

Since 2012, E2, a national community of business leaders who support sound environmental policy, has tracked tens of thousands of job announcements from wind projects in all corners of the country.

Wind energy is saving families and businesses money. An economic impact study done earlier this year showed that all utility consumers in the Mid-Atlantic and Great Lakes states—including Pennsylvania, Maryland, New Jersey, Ohio, Michigan, Illinois, and Indiana—can save close to $7 billion annually in the next decade with two times more wind entering production in those regions. That requires renewing the PTC as well as establishing business-smart, long-term policies that will keep us on the mission-critical pathway to a carbon-free, affordable, clean energy future.

Wind energy projects in development. Many of these projects are under threat if the PTC lapses at the end of 2013.

The Investment Tax Credit: A Crucial Strategy to Launch the U.S. Offshore Wind Industry

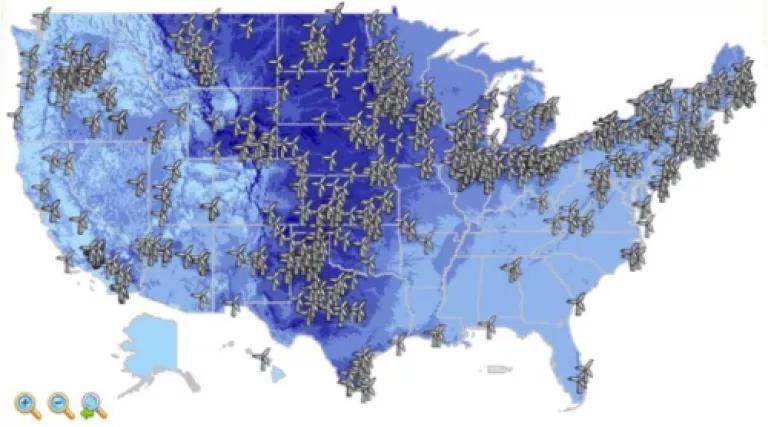

The United States has excellent offshore wind resources. As illustrated below, the Atlantic coast has particularly strong winds: a potential for over 1,300 gigawatts (GW) of energy generation. Harnessing just a fraction—52 GW—could power about 14 million U.S. homes while creating more than $200 billion in new economic activity along the coast (including 300,000 new American jobs).

Map credit: National Renewable Energy Laboratory

This NREL map demostrates the U.S.' impressive, but still untapped, offshore wind power potential.

Despite these assets, the U.S. offshore wind power industry has yet to take off. While a number of offshore wind projects are close to commencing construction, not a single utility-scale project has been built. To fulfill its significant promise and help our country catch up to other industrialized nations already enjoying offshore wind power’s many benefits, the industry needs smart policies and incentives at both the state and federal levels. In Europe, for example, the offshore wind industry is operating at full speed, with 58 wind farms offering a combined capacity of more than 6,000 megawatts, and much more to come. The industry employs 60,000 people and is growing so fast that twice as many megawatts were installed in the first six months of 2013 as in the same period last year. China and Japan have gotten involved, too, with more than 500 and 30 megawatts installed, respectively.

The most important—and immediate—action necessary to launch the U.S. offshore wind industry is extending the federal Investment Tax Credit program. The unique challenges of offshore wind energy—long investment time, infancy of the industry, and higher initial project costs—require a different form of financial incentive than on-land wind. In January 2013, Congress extended the ITC for offshore wind projects that begin construction before January 1, 2014. With that deadline now just weeks away, it’s clear that few if any U.S. offshore wind developers will be able to take advantage of the ITC because they are not yet in the construction phase. For instance, the 420-megawatt Cape Wind offshore wind project off the Massachusetts coast is fully approved and supported by NRDC and other environmental groups, but litigation has delayed the start of construction. Congress needs to act immediately to ensure that this critical tax incentive continues in order to leverage the significant private investments necessary to launch this new job-creating clean energy industry in America. It makes no sense to phase out the ITC for offshore wind before it’s ever used!

Wind energy, both on land and offshore, is an important part of our nation's future. As we replace our aging energy infrastructure and look to both rebuild our economy and compete in new global industries, all while minimizing pollution, renewable energy resources like wind power can provide the secure, reliable, and clean energy options that Americans of all political stripes want. And if we want to fight climate change and leave a better world for our children, we have a moral obligation to act now. Let’s demand a holiday miracle from Congress: swift action before the New Year to extend the PTC, ITC, and a host of energy efficiency tax credits.